Powerball Jackpot Payout 2025: Annuity vs Lump Sum - Which Nets You More After

Understanding your payout options and tax implications

When you hear about a record-breaking Powerball jackpot, the headline number is thrilling. But if you actually win, the amount you take home will be very different from the advertised figure. Understanding the Powerball jackpot payout structure is essential for making informed financial decisions.

What Is the Powerball Jackpot Payout?

The jackpot payout refers to the amount of prize money a winner receives from the advertised jackpot. Powerball offers two payout options:

- Annuity — Paid in 30 graduated annual installments over 29 years.

- Lump Sum — A one-time payment, usually 50–60% of the advertised jackpot.

Annuity vs. Lump Sum — How They Work

Annuity Option:

- Total equals the full advertised jackpot

- Paid in annual payments that increase by 5% each year

- Offers long-term income stability

Lump Sum Option:

- Immediate one-time payment

- Smaller than the advertised jackpot because it reflects the present cash value of the annuity

- Popular with most winners for investment flexibility

Taxes and the Powerball Jackpot Payout

Lottery winnings are subject to federal income tax (24% withheld immediately, up to 37% for high earners) and state taxes depending on where you bought the ticket.

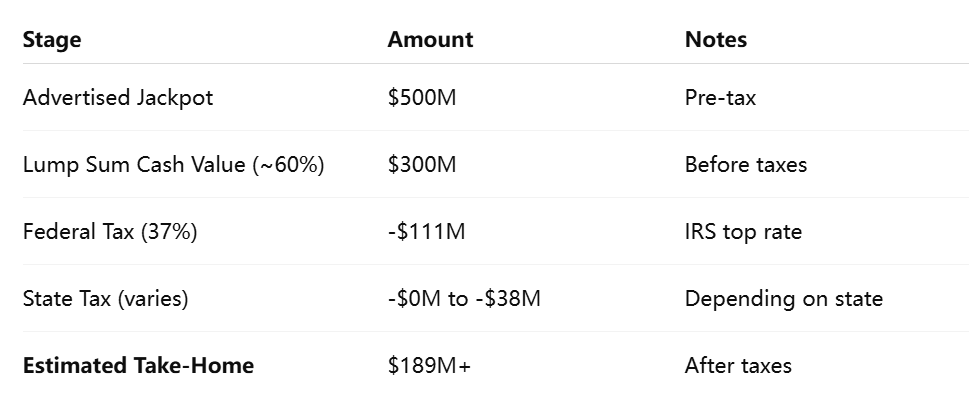

Example tax breakdown for a $500 million jackpot:

Real-Life Example — $500 Million Jackpot

If you choose the annuity, you'll get the full $500M spread over 30 payments, starting smaller and growing each year. If you choose the lump sum, you'll get around $189M after taxes (varies by state).

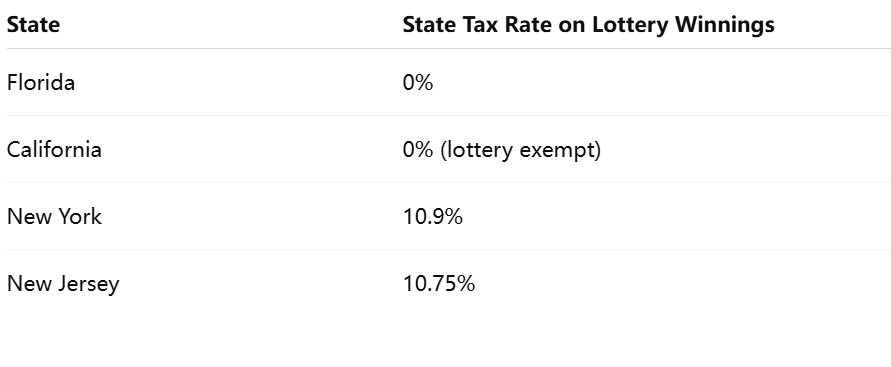

State-by-State Tax Differences

Some states like Florida and Texas have no state income tax on lottery winnings, while states like New York tax up to 10.9%. Here's a snapshot:

How to Choose the Best Option

- 💰Lump Sum: Better if you want to invest or use the money immediately

- 📈Annuity: Safer if you prefer guaranteed long-term income and reduced spending risk

Conclusion

Winning the Powerball is life-changing, but understanding the jackpot payout helps you make smart choices. Before deciding, consult a tax advisor and financial planner.

Of course, if your budget and time are limited, feel free to use the Powerball Calculator to help you.