Powerball Lump Sum Payout: Calculate How Much You'd Keep After 37% Taxes in 2025

If you've ever dreamed of hitting the Powerball jackpot, you might picture walking away with the full advertised amount. In reality, most winners choose the lump sum payout, which is substantially lower than the headline number. Here's how it works, based on official sources like Powerball.com and the IRS.

What Is a Lump Sum Payout?

The lump sum payout is a one-time cash payment equal to the present value of the annuity option. According to the official Powerball rules, this is generally about 50–60% of the advertised jackpot.

How the Lump Sum Amount Is Calculated

Powerball's advertised jackpot reflects the total of 30 annual payments under the annuity option. The lump sum is calculated by determining how much money would need to be invested in U.S. Treasury securities today to fund those payments.

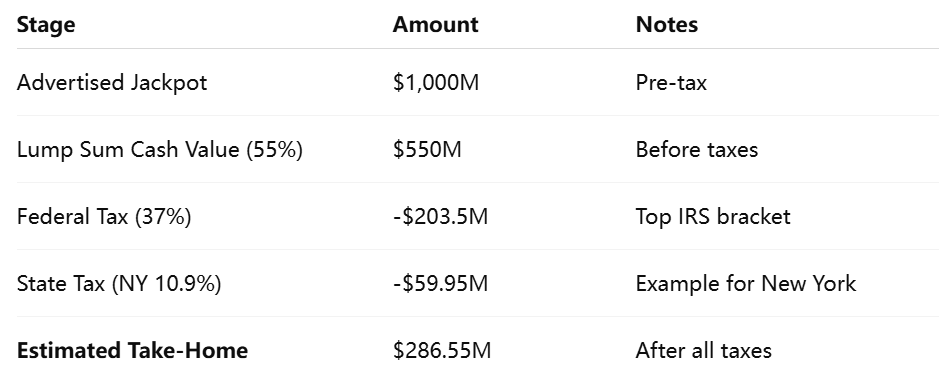

For example:

- Jackpot: $1 Billion

- Lump Sum: ~55% of jackpot value (varies with interest rates)

- Higher interest rates → smaller lump sum percentage

Taxes on Lump Sum Payout

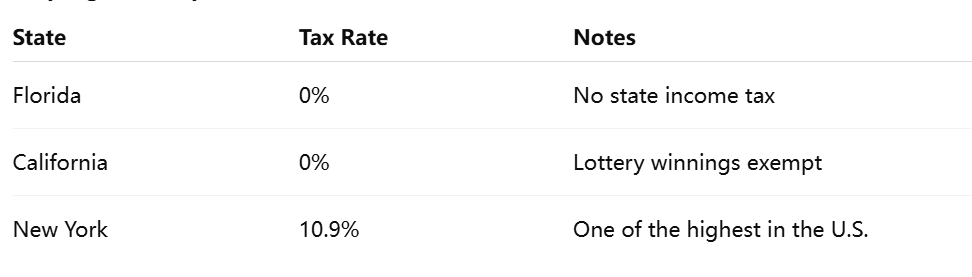

Lottery winnings are taxable as ordinary income. The IRS requires an immediate 24% federal withholding, but your final rate can be as high as 37%. State taxes vary significantly:

Example — $1 Billion Jackpot

💡 Tip:

Want to know exactly how much you would take home in your state? Use our free Powerball Calculator to see your personalized lump sum and annuity breakdown instantly.

Lump Sum vs. Annuity — Which Is Better?

- 💰Lump Sum: More control over your money, investment opportunities, but higher risk of overspending.

- 📈Annuity: Guaranteed annual payments over 29 years, reduces temptation to spend too fast, provides long-term financial stability.

Strategies for Managing a Lump Sum Wisely

According to financial planners cited by CNBC, winners who take the lump sum should:

- 1Hire a fiduciary financial advisor (not commission-based).

- 2Diversify investments — stocks, bonds, real estate, etc.

- 3Consider setting up a trust for privacy and asset protection.

- 4Plan for estate taxes early to protect wealth for heirs.

Historical Lump Sum Payouts

- Oct 2023 — $997.6M jackpot → $491.9M lump sum before taxes (Powerball.com).

- Mar 2019 — $768.4M jackpot → $477M lump sum before taxes.

Conclusion

The Powerball lump sum payout might be smaller than the jackpot number you see on TV, but it's still a life-changing fortune. By understanding how it's calculated and what taxes apply, you can make informed decisions if luck strikes.

For an instant, state-specific estimate of your potential payout, try our Powerball Calculator — it uses the latest tax data to give you accurate numbers in seconds.